[ad_1]

Several big wind farm developers, including Sweden’s Vattenfall and Denmark’s Orsted, are seeking tax breaks from the UK government or enhanced subsidies as a sharp rise in costs puts British projects at risk.

Several companies that won contracts in a large UK government auction last year to build new renewable power generating capacity from 2024 have warned ministers the projects will be difficult to deliver at the prices agreed, according to people involved in the talks.

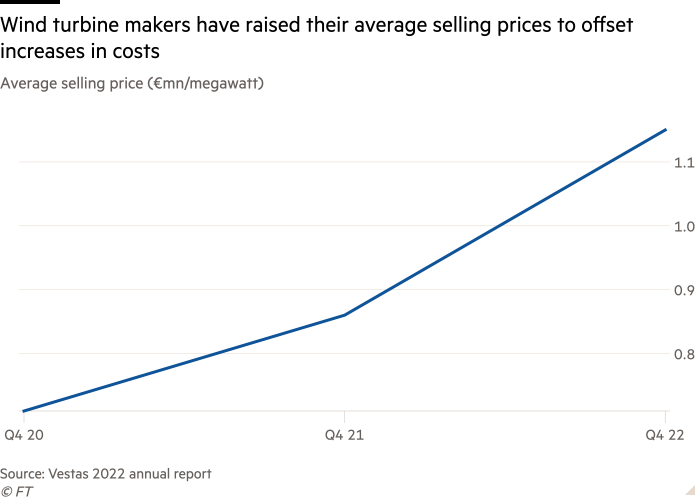

Supply chain inflation over the past year has led to a big increase in wind turbine prices, while rising interest rates have pushed up financing costs.

“There is a real jeopardy right now with that capacity [secured last year in the government auction],” said one person involved in the industry talks with ministers.

Any delays or cancellations to projects that were procured through the auction would represent a big setback to the UK government’s efforts to meet climate targets and improve security of supply by increasing domestic energy sources following Russia’s invasion of Ukraine.

Last year’s subsidy auction was the UK’s biggest to date and secured enough capacity to provide 12mn homes with cheap, low carbon power. Offshore wind dominated, with about 7GW of the total of almost 11GW contracted.

The UK has 13.7GW of offshore wind capacity operational but is seeking to increase that to 50GW by 2030 as part of an energy security strategy drawn up by ministers last year, shortly after the full-scale invasion of Ukraine.

But some wind farm developers that secured contracts in last year’s auction have either delayed or are hesitating to take final investment decisions on those projects.

This reflects how cost increases of between 20 and 30 per cent over the past 12 months made it more difficult to justify that spending without extra government incentives, said the people involved in the discussions between the industry and ministers.

Vattenfall confirmed it was seeking tax breaks in chancellor Jeremy Hunt’s March 15 Budget to help justify investing in the UK.

A person with knowledge of the talks between ministers and the sector confirmed Orsted was also among the companies seeking investment allowances, a form of tax relief. Orsted declined to comment.

Developers of renewable energy projects are traditionally incentivised to invest in new schemes through annual auctions involving state subsidy agreements, known as “contracts for difference”.

These contracts help developers secure financing for projects by guaranteeing a price for their power output. If wholesale prices fall below the level agreed in the deals, companies receive a top-up subsidy. If market prices are higher, companies pay the difference to the state.

Another person briefed on the talks between ministers and the sector described the pressures facing the wind farm industry as “unprecedented”.

They cited factors such as turbine makers increasing their average selling prices by more than 33 per cent since the end of 2021 to offset rises in the costs of raw materials such as steel and copper.

Higher financing costs, as a result of rising interest rates, was another significant factor, said this person.

Vattenfall is planning to build several large wind farms off the coast of Norfolk, which on a combined basis would power 4mn homes.

The Swedish state-owned company secured an agreement in last year’s subsidy auction known as AR4 for the first phase of its Norfolk project, the 1.4GW Boreas offshore wind farm.

Offshore wind farm developers that were successful in the auction were guaranteed prices of £47 per megawatt hour in today’s money, once their projects are operating. The contract prices are linked to inflation and guaranteed for 15 years.

Rob Anderson, Norfolk project director at Vattenfall, said the company was still committed to the project but called on the UK government to provide further help given the cost pressures.

He also warned the UK was in a competition for capital with the US and the EU, which are racing to attract clean energy investments. US president Joe Biden’s recent Inflation Reduction Act includes $369bn worth of tax credits, grants and loans to boost renewable energy and slash emissions.

Anderson said: “Given the challenging macroeconomic circumstances, [the wind farm] industry has been discussing the delivery of AR4 projects with government.

“Other parts of the world have announced major support for the offshore sector in the face of dramatically increasing costs. The UK government must do the same so we can build the clean, secure power generation we need here. Vattenfall believes that the best way forward is for support for AR4 projects to be provided via capital allowances in the spring Budget.”

The largest project procured in last year’s auction was Orsted’s 2.85GW Hornsea 3 wind farm off the coast of Norfolk.

Orsted had originally been expected to take a final investment decision on whether to press ahead with the scheme at the end of 2022 but is yet to do so, according to people familiar with the company’s plans.

Another person briefed on the discussions between ministers and the industry said some other developers were examining possible changes to subsidy agreements.

These included delaying the start date of their contracts so the initial power output from projects could be sold at higher market prices than the lower guaranteed levels stipulated in contracts.

Developers of renewable energy projects are also concerned that pricing levels for the next auction this summer will be set too low by the government.

Simon Virley, UK head of energy and natural resources at KPMG, said the government had “to find a way forward that enables these projects, and their associated supply chain investments, to go ahead” given the “exceptional cost and supply chain pressures” facing wind farm developers.

The government said that the contracts for renewables companies “already provide[d] protection to energy generators” given they were linked to inflation.

“We are taking significant action to encourage investment in renewable generation, including committing £30bn to support the domestic green industrial revolution and our renewable energy auctions have been hugely successful, contracting record capacity of almost 11GW of clean energy just last year,” it added.

[ad_2]

READ SOURCE