Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

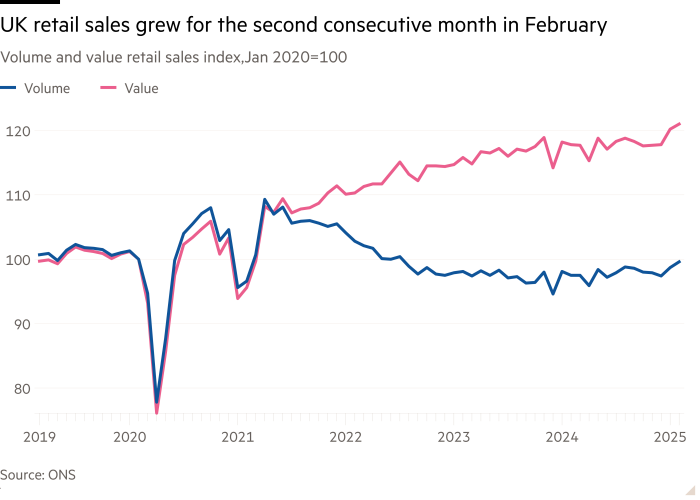

British retail sales rose by 1 per cent in February, propelled by an increase at clothing and household goods shops, beating expectations despite flagging consumer confidence and lacklustre economic growth.

Friday’s monthly data from the Office for National Statistics showed that the volume of goods bought exceeded the expectations of economists polled by Reuters, who had predicted a 0.4 per cent contraction.

The figure fell short of January’s strong 1.4 per cent increase, but still marked the second expansion in a row.

Retail sales rose 0.3 per cent in the three months to February compared with the previous three months.

Chancellor Rachel Reeves has vowed to kick-start growth by easing regulation, overhauling planning rules and backing big projects, including a new runway at London’s Heathrow airport.

But the economy is struggling to gain momentum, with the Office for Budget Responsibility this week slashing its 2025 growth projections to just 1 per cent.

Ruth Gregory, economist at the consultancy Capital Economics, said Friday’s ONS data showed that the economy remained “weak”, but added that “one hope is that households started to spend a little more freely in February”.

The figures suggest the strong wage growth seen over the past year and a half could be finally translating into higher sales, after households prioritised saving over spending last year.

Separate data published by the ONS on Friday confirmed that the economy only grew 0.1 per cent in the final three months of 2024, highlighting the challenge the Labour government faces delivering on its vows to energise the economy.

The data also showed that the household saving ratio, the proportion of income that is saved, rose to 12 per cent in the final three months of 2024, the highest level on record outside of the pandemic.

The ONS data showed that real income growth rose 4.2 per cent in 2024, the strongest in nine years, while consumer spending hardly rose.

“The better news on retail sales in Q1 provides a glimmer of hope that that might be changing,” Gregory said.

The revised official figures also showed that over the course of last year, the UK economy grew 1.1 per cent, slightly more than the initial estimate of 0.9 per cent. That followed growth of 0.4 per cent in 2023.

Rob Wood, economist at the consultancy Pantheon Macroeconomics, said he expected that growth “will improve in Q1”.

“Interest rate cuts from the Bank of England should lower saving intentions, which along with continued real wage growth can propel consumption growth,” he said.

“The signs are encouraging with retail sales recovering since October and posting a consensus-busting February rise,” he added.